As consumers become accustomed to 10-minute quick deliveries for their daily essentials, they are starting to expect similar rapid fulfillment from all e-commerce platforms. This push for ultra-fast deliveries is not only raising customer expectations but also disrupting the traditional e-commerce model in India. Major players are now forced to adapt, innovate, and rethink their delivery strategies to remain competitive in this new, fast-paced landscape.

The Rise of Quick Commerce

Quick commerce has gained significant traction in India, particularly during the COVID-19 pandemic, as consumers increasingly demand faster delivery times. In response to this evolving need, Zepto emerged as a pioneer, introducing a bold 10-minute delivery service. Launched amidst lockdowns and restrictions, Zepto’s service resonated with consumers eager for rapid access to essential goods. This innovative approach set a new standard for speed in the sector, prompting competitors like Blinkit and Swiggy Instamart to follow suit and adopt quicker delivery models. By capitalizing on the surge in online shopping during the pandemic, these companies have reshaped consumer expectations, making instant gratification a central focus in the e-commerce landscape.

How Major Brands Are Adapting to the Quick Commerce Disruption

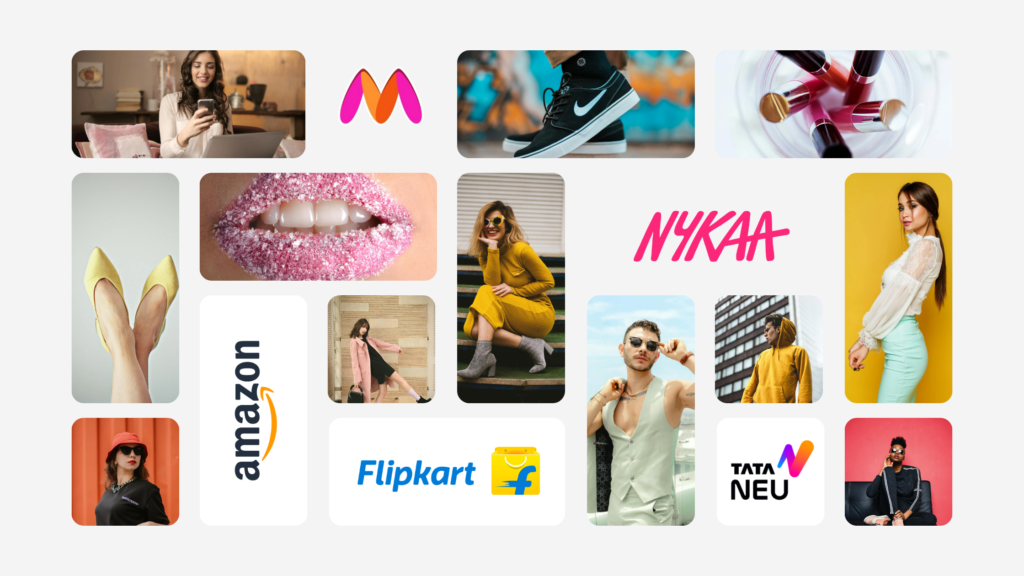

As the demand for rapid delivery services continues to grow, leading e-commerce companies are making strategic moves to adapt to this new landscape. With consumer expectations shifting towards instant gratification, brands are racing to implement quick commerce solutions. Here’s how some of the biggest names in the industry are preparing for this disruption.

Myntra is making strides in the quick commerce arena by testing a four-hour delivery service in major cities like Bengaluru, Mumbai, Delhi, and Hyderabad. This initiative reflects the company’s efforts to meet the rising consumer demand for faster fashion delivery.

Nykaa, known for its extensive range of beauty products, has recently introduced a 10-minute delivery service specifically in Mumbai. This strategic move aims to enhance customer convenience and cater to the growing demand for rapid delivery in the beauty sector.

Flipkart is also entering the quick commerce game with Flipkart Minutes, offering delivery within 8-16 minutes. Utilizing dark stores, Flipkart ensures quick access to a variety of products, from groceries to electronics.

Amazon plans to make its entry into the quick commerce space in early 2025, combining existing services like Amazon Fresh with new delivery models. Although Amazon already offers same-day delivery or faster delivery for Prime users, the rise of quick commerce is reshaping consumer expectations. As rapid delivery becomes more prevalent, consumers now view instant delivery not as a luxury but as a necessity. This shift positions Amazon to compete directly with established quick commerce leaders while adapting to evolving consumer demands.

Reliance has launched quick commerce through JioMart, initially focusing on grocery items with plans to expand into categories like fashion and electronics. This initiative leverages Reliance’s extensive retail network across India, allowing them to deliver quickly due to their existing store infrastructure. Moreover, Reliance owns popular fashion brands like AJIO, Zivame, and Trends, which have outlets in almost all major cities in India. This broad retail presence positions Reliance to effectively cater to the growing demand for rapid delivery across various categories.

Tata Group is significantly positioned in the quick commerce arena with brands like BigBasket, which has expanded to include rapid grocery deliveries. Recently, BBNow was launched, offering 10-minute delivery, catering to the growing consumer demand for speed. Additionally, BBDaily targets flat and neighboring communities with no delivery charges, enhancing convenience for consumers. Their platform, Tata Neu, integrates multiple services to further enhance consumer convenience. Moreover, Zudio, known for affordable fashion, Croma, a leading electronics retailer, and Westside, a popular fashion brand, leverage Tata’s vast retail presence to effectively facilitate quick commerce.

How Logistics Companies are Powering Quick Commerce

E-commerce and hyperlocal logistics firms are rapidly entering the quick commerce sector to capture a share of the increasing order volumes. Notable players such as Ecom Express (backed by Warburg Pincus), Shadowfax (supported by Flipkart), and Loadshare (funded by Tiger Global) are jumping on the rapid delivery bandwagon. Recently, Delhivery, India’s largest third-party logistics provider, announced plans to establish a shared network of dark stores for same-city deliveries within two to four hours. As demand surges, many logistics firms are adapting their services to meet consumer expectations, shifting from standard urban e-commerce deliveries to one- to two-hour timelines.

According to Datum Intelligence, India’s quick commerce market is projected to grow by approximately 35%, reaching nearly $7 billion by 2025, with groceries accounting for almost half of this value. The entry of these logistics companies into quick commerce signifies a crucial evolution in the industry, driven by the increasing consumer desire for instant delivery across various product categories. This trend highlights the need for logistics providers to enhance their infrastructure and adapt to the fast-paced nature of modern e-commerce.

The Road Ahead

The quick commerce sector in India is set to transform the way consumers interact with e-commerce platforms, emphasizing the importance of speed and convenience. As established players like Amazon, Reliance, and Tata Group ramp up their efforts in this space, and logistics companies refine their operations, the future of retail is poised for a significant shift. With the quick commerce market expected to burgeon, the ability to adapt and innovate will be crucial for brands looking to thrive in this competitive environment.